IT’S TIME FOR A CHANGE

- By aiofp_admin

- Comments are off

This paper follows ‘THE OTHER REFERENDUM’ document distributed on 15/5, it has a more detailed look at the FPA/AFA merger ‘scoreboard’ which does the FAAA no favours.

It seems the new FAAA Board expects Advisers to either forgive the ‘old’ FPA/AFA entities for cooperating with the Liberal Party to implement such devastating anti – Adviser legislation OR they think Advisers have a short – term memory loss OR the Advisers are confused with which Government did what in the past.

The merged FAAA entity is a change in name only with all the same players involved, but just in case there is short term memory loss or confusion with Advisers on past detail, we will remind everyone of the facts –

- FOFA 2012/14 – evolved under the RUDD/GILLARD ALP Government where product commissions were banned, risk commissions tolerated, ongoing revenue grandfathered, safe harbour evolved and best interests implemented – a concern at the time but was eventually considered to be fair and reasonable.

- FASEA/LIF/Grandfathering ban/ridiculous compliance 2015/22 – evolved under the Abbott/Morrison Coalition Government, championed by Ministers FRYDENBERG/O’DYWER/HUME and supported by FPA/AFA/FSC – a devastating series of legislative pieces designed by the Institutions to cull Advisers causing widespread misery and suicides. Considered by many to be the darkest period in financial services history.

With all circumstances considered, we find it astonishing that Advisers still want to support FAAA once the scoreboard is analysed [or even just glanced at]. It is no wonder the FPA/AFA names have been expunged for ever, the financial and mental damage these organisations have caused to thousands of families is immeasurable.

Furthermore, some blame the AIOFP for being too divisive with our candid views, let us point out that these views originate from the ruinous and cataclysmic actions of the FPA/AFA over the years. This is precisely why the AIOFP was formed 25 years ago by 3 Dealer Groups, we are not going to sit back and let the FPA/AFA get away with anti – Adviser behaviour that assists the Institutional agenda.

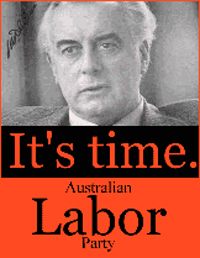

The recent poor handling of the FAAA merger name is reminiscent of the 1972 Gough Whitlam ‘IT’S TIME FOR A CHANGE’ campaign that changed the political environment. The FPA/AFA have become too close to the Liberal Party and the Banks over the years where they have received Liberal Government grants and millions in sponsorship support from the Banks in return [we presume] for cooperation with legislative outcomes.

The FPA/AFA latest support of the Minister Hume appointed LEVY/QAR Report that dilutes consumer protection and opens the door for the Banks to re – enter advice is yet another example of their support for the LIBERAL/Banking nexus. In addition, the recent vocal support from controversial outgoing Shadow Spokesperson Stuart Robert for the FPA/AFA does FAAA no favours to say the least.

This past unholy relationship of FPA/AFA representing Advisers in Canberra must end. It is delusional that these two Liberal Party biased Associations who supported the draconian legislation in the first place, are now suggesting they can amend it. Their SHORT strategy is flawed and they stayed with the LONG Liberal Party relationship for too long, some very poor management decisions in our view.

Some may say the AIOFP is too close to the ALP BUT there is a key difference, we are using our influence to act in the best interests of Advisers and consumers by eliminating the nasty and negative aspects of the Liberal Party’s Agenda over the past 9 years. We are educating all Politicians on our industry to justify amendments, we are not cooperating with malevolent legislation to get self – interested conflicted outcomes.

To summarise, we do not wish FAAA any good luck for the following reasons –

- Despite this merger there are still too many Associations in the Advice space, only Adviser centric Associations should be involved with Canberra representing Adviser interests. The FPA/AFA are not Adviser centric and do not deserve another chance in our view.

- FPA/AFA recently engaged market fringe Association entities to join JAWG to bolster their own lost credibility, this has only further confused Canberra with who to deal with, a very poor outcome.

- FAAA cannot even get their own new branding right. In addition, the second word of their name says it all, we assume they had the option to use ADVISER but selected ADVICE, what does that tell you? [see attached legal letter]

- Remember this announcement by Minister O’Dywer? https://ministers.treasury.gov.au/ministers/kelly-odwyer-2016/media-releases/life-insurance-commission-reductions-benefit-consumers

- The last sentence says it all. LIF has been the most devastating piece of Legislation in living memory and the FPA/AFA teamed up with the FSC to assist it through both Houses of Parliament – an unforgivable act. Some of the key Association personnel who backed Minister O’Dywer and this legislation are still involved with FAAA.

- The FPA has made it quite clear in the past that their first loyalty is to consumers NOT Advisers, the problem has been Advisers not realising this critical difference and/or joining to access the failed CFP designation. We are also critical of the member disciplinary process they have in place.

- Why the merger? Severely damaged reputations, both in financial trouble after their recent results and members deserting them – two more compelling reasons why they should not be representing Advisers in Canberra. It would be interesting to see how both would be financially placed if it was not for the Bank millions they have received……this money should be distributed back to the suicide affected families who have suffered.

Why the AIOFP now leads the Advice Community.

- We have always acted in the best interests of Advisers over the past 25 years.

- We have excelled in our advocacy role delivering the FASEA/Senator Rex Patrick date solution, the 10 year Education pathway, helped remove Frydenberg from his seat and we work closely with the ALP and Cross Benchers in the Senate.

- We are currently pursuing Exam amendments, a realistic education pathway for Risk Advisers, the ASIC levy and risk commission increase with Treasury and the Ministers office.

- The AIOFP’s Certified Financial Strategist [CFS] designation is transferable if no longer a member.

- Preferential PI Cover, commodity discounts, a CEP solution and new client programs are available for members.

- A highly successful 22 year conference program with annual onshore and offshore events to meet with like – minded professionals.

The AIOFP believes 3 Associations is sufficient for the Advice sector, we suggest the SMSFA, SIAA and AIOFP are the worthy entities to represent the diverse Advice community in Canberra.

Peter Johnston

Executive Director

Association of Independently Owned Financial Professionals